Knock’s Wild Ride from $2B to $220M in 12 Months

This story is an honest, transparent account of how we grew transactions, revenue, and gross profit triple digits at Knock over the last 12 months but thanks to a global pandemic and five macroeconomic implosions we missed the IPO window, were nearly acquired and ultimately secured a $220M round of financing in what was a painfully prolonged, but successful, fundraising process.

My co-founders Jamie Glenn, Karan Sakhuja, and I founded Knock in 2015 on a mission to use technology to revolutionize the very broken process of buying and selling a home. As part of the founding team at Trulia, Jamie and I helped democratize the information buyers needed to make the largest purchase of their lives. Knock has always been about doing the same for sellers. We built an amazing team of ~300 Knockstars, raised $100M from top-tier investors, hundreds of millions more from top-tier lenders, and invented the Knock Home SwapTM, a convenient and certain way to trade in your old house for your new dream home. Our innovative new concept spawned a slew of copycats and an entirely new category known as Buy Before You Sell. Steve Jobs said that imitation is the highest form of flattery and we were downright blushing!

In March 2021, we hired Goldman Sachs to help take Knock public on the New York Stock Exchange via a SPAC. Internally, we called this Project Cosmos. A few weeks later, Goldman valued Knock at $2B and we entered into an agreement with a reputable, repeat SPAC sponsor represented by Morgan Stanley. We were on top of the world and our mission was being fulfilled, or so we thought.

The SPAC Slump

Just two months later we were ready to start our investor roadshow, but enthusiasm for SPACs started to wane and companies that went public via SPAC suddenly traded at an average of 39% below their highs. We proactively slashed our $2B valuation nearly in half before going out to investors with the goal of raising nearly $400M in a public offering

Red Hot Summer Housing Market

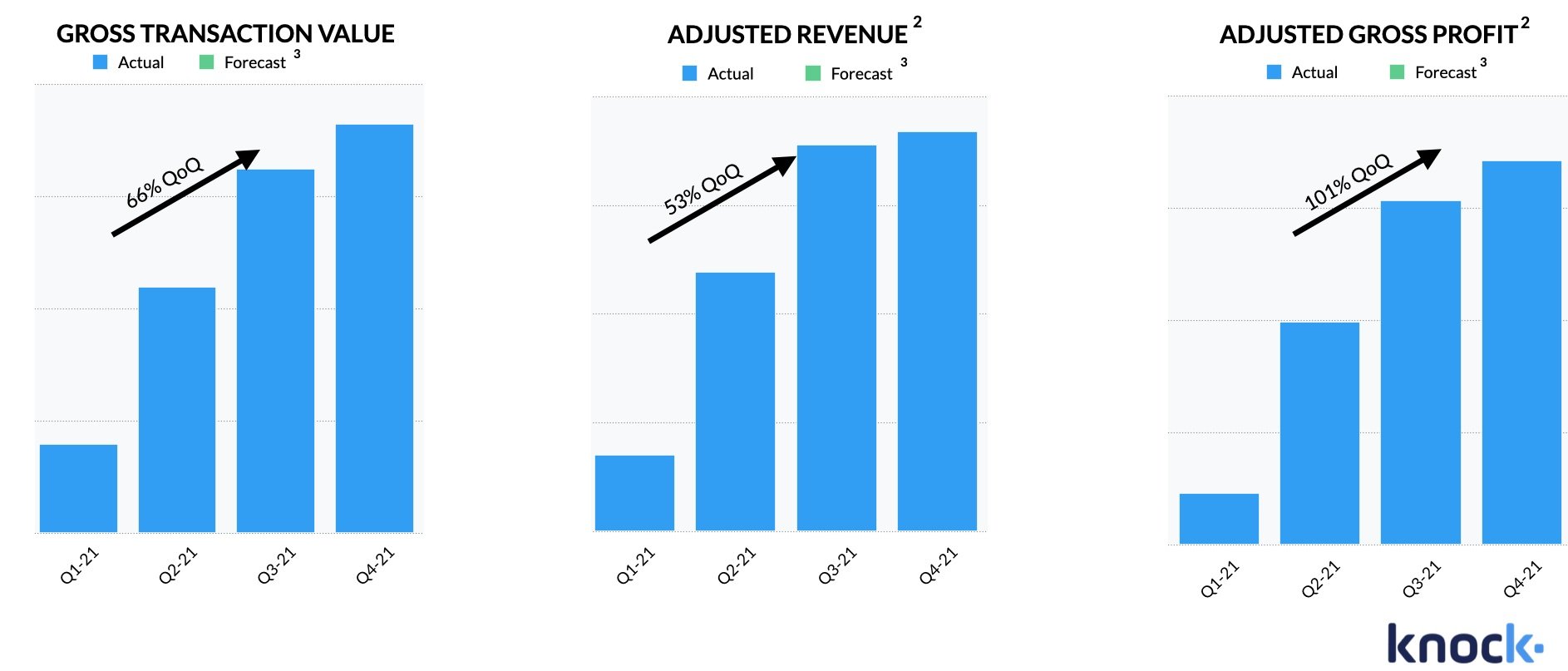

We kicked off our institutional roadshow in June as the housing market continued to heat up. On one hand, homebuyers needed the Knock Home Swap more than ever and our business was on fire. On the other hand, the SPAC market continued to cool down. By July, Knock was in 50 markets, up from five just a year earlier, resulting in double-digit growth in transactions, revenue and gross profit, which fueled continued growth.

By the end of July, it was clear the SPAC market was not going to rebound as it had done two times prior, so we abandoned the incredibly arduous process that half our executive team along with 40 highly skilled bankers, lawyers, analysts and private equity folks spent months preparing for and months more executing to pivot to raising a private round of financing.

Delta’s Revenge

As Goldman Sachs helped us prepare to raise $150M in a private placement in August, they and the rest of Wall Street were banking on investors coming back in September re-energized and ready to put money to work again. That was true for a few weeks, but then the Delta variant started raging and fears of another shutdown and inflation sent the stock market into a tailspin.

Zillow Offers Implosion

The financial markets started rebounding at the end of October and we got $5-$10M commitments from several of the 100+ investors we pitched in our IPO roadshow. While we had our fair share of growing pains, our business continued to grow and expand double and triple digits month after month and our mission started to come into focus again. And then on November 2, yet another external force knocked us and the entire real estate tech sector on our collective asses. Zillow announced that it was shuttering its iBuying business, Zillow Offers, and would take a $540 million loss.

On one hand, this proved Knock pioneered the superior alternative model. Knock does not buy houses from consumers at a discount like iBuyers, but rather we lend consumers 100% of the money they need to buy their new house and help them manage the entire process of buying and selling with their agent in our mobile apps. But investors needed a timeout to understand how the Zillow Offers news would ripple through the entire sector. Meanwhile, we continued to grow Knock across every metric that mattered to the business.

A Knock at the Door

The first case of Omicron was detected on December 1, creating yet another headwind to raising capital for any company. While investors were on the sidelines, we were approached about an acquisition. It was December 15, which meant we would have to work through the holidays to evaluate an acquisition - a stretch to say the least. It was love at first sight, but like many love stories, timing is everything. Unfortunately, no agreement could be reached in part because the would-be acquirer’s stock, and therefore buying power, had been cut nearly in half from recent highs like most other tech stocks. We parted with a potential partnership and we got back to raising a private round with the hopes that the new year would bring renewed enthusiasm to the markets and investors.

Happy New Year!

Having dialed in our new market playbook to a science, we kicked off 2022 by launching our 75th market - Seattle, Washington. Home to Amazon, Microsoft, and Zillow, Seattle brought our real estate agent partner network through which we reach consumers to 115,000 agents!

Life & Death

Our fundraising had started to come together again weeks earlier and we were most of the way there, when on Thursday, February 17, I got a call from my sister that my Dad was admitted to the hospital and I needed to fly home that day, which I did. It turned out that he was diagnosed with late-stage cancer and likely only had a few weeks. I thought I could focus on my family and let my team take it across the finish line. Unfortunately, the rout in the financial markets continued, led this time by tech stocks including Facebook, Netflix, and Zillow, all down 33% to 40% in just a few weeks sending investors into a tizzy. Worse still, we lost my Dad just 10 days after I got that call from my sister, but not before me and my family had an amazing three days with him where he was full of energy, full of life, and very much his old self. As the character, Anton Ego said in my favorite Pixar movie, Ratatouille: “What we need is some fresh, clear, well-seasoned perspective.”

World War III?

Impact of Russia’s Invasion of Ukraine

While the exodus from tech stocks didn’t help, the straw that broke the camel’s back was Russia's horrifying full-scale invasion of Ukraine. The U.S. housing market continues to be one of the strongest in history and our business continues to beat records monthly, but the rest of the market and the world continue to be full of volatility and uncertainty, pushing many investors into “risk-off” mode.

Bitter Sweet

This chapter of our story ends nearly a year to the day it started and the next begins today, March 15, as we announce that we have secured $220M of new funding, including a first close on $70M in equity and $150M in new debt used to power our payments platform that helps our customers finance their dream homes. The equity round was led by Foundry Group with participation from existing investors First American Financial, Corizon Capital and RRE Ventures as well as several new investors, including the National Association of Realtors, director/producer M Night Shyamalan and Mauricio Umansky, Co-founder of luxury real estate brokerage The Agency. This capital provides a strong foundation and puts us on a path to profitability by year-end so we can continue on our mission of revolutionizing the home buying experience for everyone.

I want to give a huge shout-out to our incredible investors and board members without whom our dream would not be a reality. In particular, Seth Levine and his partners at Foundry Group, Raju Rishi and the amazing team at RRE Ventures, Paul Hurst, and his hands-on, super accessible C-Suite at First American Financial, Vijaya Kaza at Airbnb, Paul Habibi at Grayslake and UCLA, and Jed Nachman, COO at Yelp. They pulled out all the stops and had our backs at every twist and turn.

I also want to add a big shout-out to our SPAC sponsor. They too stuck by us long after we were forced to abandon our IPO to help us secure this financing without any financial incentive to do so. Thank you, guys!

People First

Although this is good news, it’s not a happily ever after ending. While substantial, the capital we raised is much less than what we set out to raise in our IPO, requiring us to rightsize the business, including the difficult decision to part ways with many of our beloved Knockstars. This is why today’s announcement weighs heavily on us and me, in particular. These are people who worked tirelessly to make Knock the most simple, certain, convenient way of buying and selling a home.

I am so incredibly proud of and grateful to each and every one of them. They are our friends and we are going to make sure that they have the benefit of participating in our future success and realize the upside of all their hard work, even if they are no longer with us, by continuing to be Knock stockholders and alumni.

It’s Only and Always Day One!

Having been in the startup world for the past two decades, I know firsthand that it's a feat that our company has had the fortitude to not only survive but thrive the past year. But we have and here's why.

The first reason is POPSICLE. This mnemonic describes our company culture and core values and it starts with Passion, Openness, and being People first! Those people include our Knockstars, our 115K+ agent partners, and our thousands, and eventually millions, of customers.

Second, we’re customer obsessed! Knock offers a long-overdue solution for millions of Americans who buy and sell homes each year. We offer the most simple and convenient solution to the painful process of buying and selling a home, and as our relationships grow throughout the industry, agents are increasingly offering Knock to their clients as the best way to realize their homeownership dreams. Amazon founder Jeff Bezos famously coined “It’s Always Day One” to denote how critical it is for companies to maintain their nimbleness, entrepreneurial spirit, passion, and, most importantly, obsessive customer focus. For the first time in decades there is a ton of momentum behind fixing the very broken home buying process and we at Knock have been and will continue to be at the forefront of that revolution. We are just getting started. Onward and upward!